resources/insights

financial insights to keep you ahead

experienced

trusted

proven

5 Steps to a Secure Retirement

Tax Strategies for Small Business Owners

Smart tax planning is essential to protecting your business’s bottom line. Our guidance helps small business owners identify deductions, optimize expenses, and structure their finances for maximum tax efficiency. From choosing the right business entity to planning quarterly payments and leveraging available credits, we provide practical strategies that reduce tax burdens and support long-term growth. With the right approach, you can keep more of your hard-earned revenue and reinvest confidently in your business’s future.

How to Protect Your Investments in Volatile Markets

Market volatility is inevitable, but with the right strategy, your investments can stay resilient through uncertainty. This guide explores proven approaches to safeguard your portfolio, including diversification, disciplined asset allocation, risk management, and long-term planning. Learn how to avoid emotional decision-making, stay focused on your goals, and position your investments to weather fluctuations with confidence. With smart, proactive measures, you can protect your wealth today and strengthen your financial future.

Retirement Savings Calculator

Estimate your future retirement income with clarity and confidence. Our Retirement Savings Calculator helps you understand how your current savings, contributions, and investment growth can support your long-term goals. With simple inputs and instant results, you can see where you stand today and what adjustments may help you build a more secure and comfortable retirement.

90%

Short heading goes here

90%

Short heading goes here

Investment Growth Planner

Take control of your financial future with our Investment Growth Planner. This tool helps you visualize how your investments can grow over time based on contributions, timelines, and expected returns. With clear projections and easy-to-understand insights, you can make informed decisions, adjust your strategy, and stay on track toward building long-term wealth.

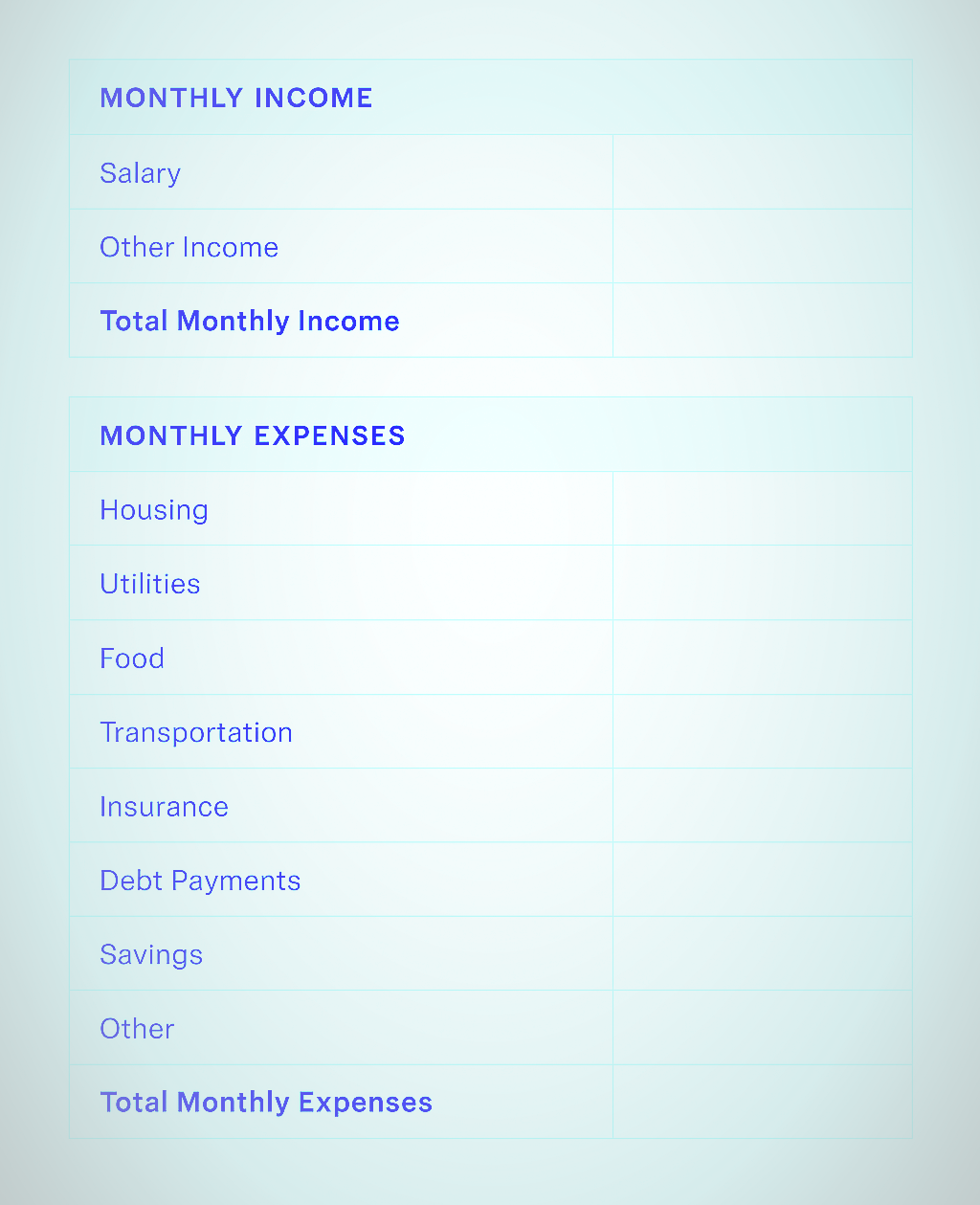

Stay organized and in control of your finances with our Budgeting Worksheet. This easy-to-use tool helps you track income, expenses, and monthly spending habits, giving you a clear picture of where your money goes. With better visibility and structure, you can make smarter decisions, reduce overspending, and build a stronger financial foundation.

FAQs

Got a question? We’re here to help.